Now that you know the facts about a Bachelor of Finance at Monash, you’re probably wondering what the degree’s actually like!

To help us get some extra insight, Khit Paing, a third year Finance student at Monash, told us all the secrets to the degree.

Let’s get into it!

Why should you study a Finance degree at Monash?

Top 3 Pros of a Finance Degree

Top 3 Cons of a Finance Degree

Things to Know Before Starting Monash Finance

What Makes this Degree Different

Motivations for Studying Monash Finance

Potential Career Paths

Why should you study a Finance degree at Monash?

A Bachelor of Finance at Monash is ranked very highly, coming in as the 4th best finance degree in the country. Monash is itself a renowned university, consistently ranking in the global top 100.

The Monash Business School is very much engaged in seeing its students succeed, with an emphasis on industry experience and connection. Most of the faculty is made up by academics who have worked, or are still working in the industry.

Khit found this to be “one of the most rewarding parts of the degree because you’re constantly reassured by up-to-date industry-relevant advice”.

Top 3 Pros of a Finance degree

#1: Learn practical skills about money

Studying Finance gives you a setting in which you can learn about the inner workings of money and how it affects everyday life.

In first year, you take subjects like principles of microeconomics, principles of macroeconomics and introduction to financial accounting/accounting for managers. These give you a great introduction to economics and financial management.

#2: High level units are often taught by industry professionals

This is a great opportunity to gain insight into what is really going on in the industry. Tutors and lecturers can share their own experiences, and give up-to-date examples to help in understanding financial theory.

Khit in particular found this extremely beneficial, as he also saw their guidance as aspirational. He said, “I felt like I could see where I would end up after I graduated through them and also found their advice more relevant.”

#3: Usually less assessments

For Khit, the assessment structure worked out really well. Having done A-Levels at high school, the structure of low-weighted, incremental tasks was not his style.

“I like to just do one or two exams and then it’s over, so I found this style really good,” he shared. Finance at Monash is better suited for students who like a few, high-weighted assessments throughout the semester — especially exam-style ones.

Top 3 Cons of a Banking and Finance degree

#1: There are a lot more readings to do than other business units

Finance requires its students to work with a lot more theory than you might expect. It’s all about applying theory to everyday, financial concepts and situations.

It definitely comes down to preferences, but Khit found that the readings for Finance units could be quite taxing. There are a lot of readings to do — from textbooks to academic papers.

#2: Some units overload you with work

While Khit enjoys the structure of having less assessment tasks, but more weighting added to them, he did find that some classes would have a few smaller tasks scattered throughout. However, he found that the small weighting of the task would often be unbalanced by a much larger workload than was necessary.

He said, “An assignment would be worth only 10% but we would have so much to do for it.” This can create a lot of stress for students, so it’s important to be aware of how much each assessment is worth, and use that as a guide.

#3: You need to be decent at Maths

For some, the amount of mathematical knowledge required to do this degree may be challenging. While Khit loves that side of the degree, not everyone shares the same enthusiasm and you need to be aware of it before going in.

What do you wish you had known before starting Monash Finance?

Get involved with societies! Khit is the executive of the Accounting and Finance Club at Monash, and says it’s one of the best ways for students in these degrees to get to know each other outside of class.

The society holds welcome nights, welcoming events, industry and study-related talks, and they also share jobs relevant to students. Khit says, “[They] give you real, first-hand insight through networking events, and allow you to make friends who do the same degree.”

It’s also important to note that this degree is maths-heavy. Sure, it’s not like engineering maths, but it still requires you to be good at working with numbers.

What makes this degree different from the ones offered at other universities?

Monash Business School provides Business School Peer Mentoring in first year, where new students are connected with a peer mentor. This is a great opportunity to get to know the ins and outs of life for Finance students, as well as make lifelong friends and connections.

The Business School also offers Industry and Alumni mentoring for penultimate and final year students. As part of the program, they are connected with a mentor relevant to their professional goals who can help them make a start in the industry.

These are opportunities somewhat unique to Monash, that set its Finance course apart from others in Australia.

What inspired you to choose Monash Finance?

Studying a Bachelor of Finance is great if you are interested in maths and money. It requires a lot of numerical mathematical skill, as students must have achieved at least 25 in any Mathematical Methods or Specialist Mathematics in the VCE.

The degree is focussed on understanding what goes on behind the scenes of the financial system, while teaching students how to invest in and manage money.

Studying Finance can give you insight into equities and investment, financial modelling, debt markets and fixed income securities, corporate finance and financial modelling. You come away with financial skills that can be transferred to any industry.

It can also help you develop analytical skills, as many finance units are quite heavily theory-based.

While Khit found the theory side of finance quite frustrating at times, it is useful for understanding the meaning behind concepts, which you can then apply to real-life industry situations, like capital investments, foreign exchange, financial forecasting, stocks and bonds.

What are the possible career paths?

This degree is great because it can act as a stepping stone into a lot of different industries. Every industry needs people educated in finance, so you can apply it to many different places.

However, most graduates stick to more traditional paths by going into financial institutions, such as banks and investment companies.

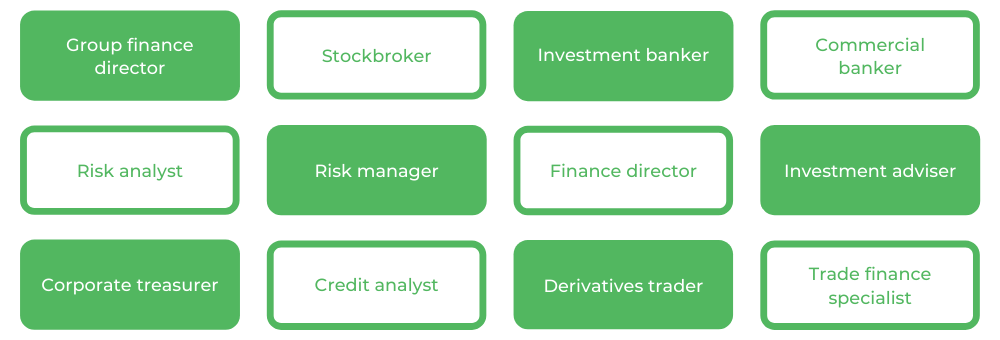

Jobs like stockbrokers, investment bankers, commercial bankers and risk analysts are commonly associated with finance degrees — but you can always look outside the box!

Specific roles include:

- Group finance director

- Stockbroker

- Investment banker

- Commercial banker

- Risk analyst

- Risk manager

- Finance director

- Investment adviser

- Corporate treasurer

- Credit analyst

- Derivatives trader

- Trade finance specialist

Elizabeth Noonan is a Content Writer for Art of Smart and an undergraduate student at the University of Sydney. There, she studies a Bachelor of Arts/Advanced Studies, majoring in Media and Communications and French. Elizabeth is a huge movie buff and hopes to go into journalism after she finishes her degree.