So you’re interested in finance, but you’re not sure what specific role you’d like to work in? Or perhaps you want to be a Financial Analyst, but want to know what it involves?

This article will walk you through everything you need to know about being a Financial Analyst, through the eyes of someone with real industry experience! This includes what the average day looks like, key skills, experience and study, and advice.

So without further delay, let’s dive in!

Meet Joanne

What is a Financial Analyst?

Steps to Becoming a Financial Analyst

Future Outlook

Best Thing & Worst Thing

Advice for Aspiring Financial Analysts

Meet Joanne

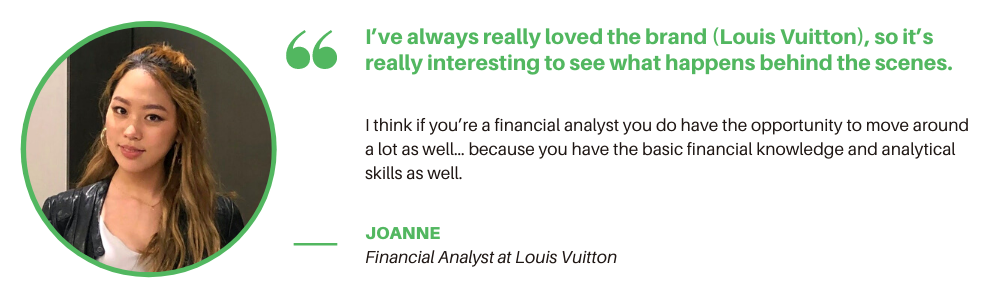

Joanne has previously worked as a Financial Analyst for the fashion brand Louis Vuitton and is currently a Pricing Analyst for Woolworths. She has worked in a junior position for both of these jobs, and is also studying at the University of Sydney!

How did you end up in this role?

The skills learnt in her Bachelor of Finance were key to her acquiring the position of Financial Analyst, says Joanne.

She says she ended up in this role as a key part of her developing these skills and understanding what happens in the financial sections of large businesses, in order to support future employment prospects.

Studies and Experience

Joanne is in her third year of a double degree in Economics and Advanced Studies majoring in Financial Economics and Accounting. She says this degree provides an introduction to soft and hard skills required to work as a Financial Analyst.

She had also previously worked in retail and as a result had lots of experience in customer service, supporting stakeholders and basic communications skills.

What made you want to work in this role?

Joanne says she ended up working in the role as she enjoyed critical thinking and analytics; she also had a strong passion for the brand Louis Vuitton and was interested in seeing what happened behind the scenes of the company!

What is a Financial Analyst?

Broadly speaking, a Financial Analyst is responsible for the financial management of a company, particularly to determine the best use of resources to achieve business goals.

A Financial Analyst is crucial to businesses, institutions and banks making well-informed financial decisions.

Roles and Responsibilities

In this position, you’ll be expected to perform financial forecasting, conduct market research, report on the company’s financial performance, analyse past performance for optimisation, identify trends and make recommendations, and work closely with the accounting team to facilitate accurate financial reporting.

Joanne says that her responsibilities as a Financial Analyst throughout a ‘typical day’ were dependent on the time of the month due to the business cycle.

Specifically, “The end of the month would be very busy, as well as the first week of the month. This usually included reporting and sending out financial statements, as well as declaring the sales of every store in Australia.”

The role usually required her to sit at a desk most of the day with minimal face-to-face communication, however this can differ depending on the office and work culture of the corporation one is at. One of the most important skills included using Excel to create spreadsheets and reports.

“Generally on the days of the month that were not busy, the tasks were quite repetitive. Our office was the headquarters and support office, so we would spend every morning replying to emails sent by the stores and helping out as much as possible. That was the basic task everyday,” shares Joanne.

She adds, “I would also do a risk assessment and a sales reconciliation every single day. My shifts would usually be 9am to 6pm.”

Note: A sales reconciliation is the process of comparing transactions and activity to supporting documentation. Reconciliation involves resolving any discrepancies that may have been discovered.

Which industries can this career be found in?

Financial analysts are needed in a broad range of industries. Most commonly according to JobOutlook, you can find them in the following:

-

- Financial and insurance services

- Professional, Scientific and Technical Services

- Manufacturing

- Public Administration and Safety

- Other industries

What jobs do people sometimes confuse this with?

People might commonly confuse a financial analyst with a pricing analyst and a financial manager.

Pricing Analyst

A pricing analyst is responsible for determining the ideal target price for products of the business to analyse competitor pricing matched with market expectations.

On the other hand, a financial analyst is more concerned with more broadly optimising the financial performance of the business of a corporation for which they work by analysing and forecasting trends.

Financial Manager

Finance Managers plan, organise, direct, control and coordinate the financial and accounting activities within organisations.

Financial analysts help managers to review data on investments, accounting, and other aspects of business so that financial managers may make suitable decisions.

Characteristics and Qualities

| Characteristics | Types Required |

|---|---|

| Knowledge | Economics and accounting, administration and management, mathematics, personnel and human resources, English language |

| Skills | Analysis of financial resources, critical thinking, judgement and decision making, systems analysis, active learning |

| Abilities | Problem spotting, oral expression, deductive reasoning, working with numbers, written comprehension |

| Activities | Making decisions and solving problems, analysing payment and orders, making sense of information and ideas, planning and prioritising work, communicating within a team |

Below are the various skills sought after in a Financial Analyst.

Critical thinking as well as knowledge in accounting and economics established in a finance degree are further developed in this role. This is done through practical immersive analysis of business metrics in order to forecast future trends, and repetitive day-to-day tasks such as using computer software like Excel.

Administration and communicative skills are both developed in this role through communication with a team to make appropriate evaluations, particularly to accountants and financial managers, as well as reporting on and sending out financial statements.

Steps to Becoming a Financial Analyst

What should you study?

Typically you should study a Bachelor’s degree in accounting, business administration, economics, finance or statistics to work as a Financial Analyst. These courses can be undertaken at most universities.

These are some degrees that can help you towards a role as a Financial Analyst:

In addition, you may have a competitive edge with a Chartered Accountant (CA) or Certified Practising Accountant (CPA) qualification.

How long does it take to become a Financial Analyst?

Typically a Bachelor’s degree in finance and/or accounting will take three years, and a Master’s degree to provide you with a competitive edge can take another two!

However, you can always take on Junior Financial Analyst roles prior to this (and it is advised, for experience), which essentially will allow you to partake in a professional role prior to finishing your degree.

Industry Knowledge

The most important program to know when becoming a Financial Analyst is Excel. Excel is where much of your work in creating spreadsheets and reports will be based!

If you are working for a retail company, then you may also need to learn SAP, a software for accounting information.

What will this career look like in the future?

How in-demand is this career?

Financial analysis is a relatively in-demand career, because its roles and responsibilities are necessary across a range of industries, and key to making optimal business and economic decisions. This is also evidenced by its forecasted job growth expectancy over the next 5 years (24.7%).

Not only this, Financial Analysts require a fairly high skill level and a Bachelor’s degree, meaning there are fewer people out there who are capable of fulfilling such tasks!

However, Joanne says that, rather than financial analysis, data analysts are in increasingly greater demand. This job includes the use of cookies and other user-generated data rather than financial statements in order to maximise things like online advertising for businesses.

Are there opportunities to grow or specialise?

There are many opportunities to specialise and move between different careers, says Joanne, due to the transferable skills of accounting knowledge, analytical skills, and Excel skills.

A Financial Analyst may specialise or transfer to various related roles such as pricing analyst, financial manager, or business analyst. Moreover, many Financial Analysts tend to circulate within a certain industry such as fashion, says Joanne.

If you have a dual interest in finance and another industry then this career may be for you!

Salary

| Annual Salary | Future Growth | Skill Level Rating |

|---|---|---|

| $110,000+ | Strong over the next 5 years | High skill |

Influential Trends

In the past 20 years, the Financial Analyst career has undergone rapid change, predominantly due to computerisation of processes. The digital transformation of the industry of finance analytics has rapidly increased the amount of data available for analysis, and the extent to which analytics influence business decision-making.

The Future of this Industry

Despite the immense increase in finance data analytics in the past decade or two, the industry presents much untapped potential. For example, only 14% of finance organisations are successfully harnessing the large volumes of data generated to create valuable business insight, according to a 2020 FSN Future of Analytics in Finance report.

It’s predicted that the future of this industry will involve greater integration of different kinds of data into traditional models of financial analysis. This can potentially maximise business decisions, in light of new technologies which enable the capture of this data, the increasing emphasis of online platforms and forms of advertising in different business models, and higher numbers of customers congregating online!

Best Thing & Worst Thing

What do you enjoy most about this job?

What do you feel is the worst part of this job?

“Sometimes the job can get really tedious and repetitive but it all depends on what company you’re working at… [At some companies] there is a lot of team working and communication,” says Joanne.

She adds that enjoying your job as a Financial Analyst is about finding the correct environment and responsibilities fitted to it to work within. This particularly applies to a social versus independent work style and office.

Advice for Aspiring Financial Analysts

What do you wish you had known before you started working in this career?

“I wish I had not only thought of my job as a task but really understood what I was doing. I think it’s important to try and get the most out of your experiences,” Joanne mentions.

She also says that it’s important to also look at your role within the bigger context of the business, and learn from how all the different jobs within it work together.

Why should people consider taking on this career?

Joanne says that the analytical and critical thinking skills in a Financial Analyst’s jobs are very relevant and transferable to other career options such as business, if you are looking for career mobility or uncertain about what you want to pursue in the long term.

She also adds that financial analyst is a higher paying job than something like an accountant!

Job Flexibility

Joanne says that her job at Louis Vuitton was not highly flexible, as she was required to be in the office to work (even during COVID). However, this may differ between companies, she says!

Since much financial analysis work occurs on computers, remote work is a more viable option for this career as opposed to others (such as something more hands-on or customer-service based).

What is the workplace culture like?

Workplace culture is highly varied across different companies, says Joanne, and shaped by the individuals one works with.

Due to the computer-based style of work, interaction with co-workers or business customers can often be minimal. Nonetheless, a supportive manager can highly improve the workplace culture of a financial analyst’s job, says Joanne, through strong leadership and teaching skills!

Zara Zadro is a Content Writer for Art of Smart and a current undergraduate student at the University of Sydney. She studies a Bachelor of Arts/Advanced Studies majoring in Media & Communications and English. In her free time, she enjoys reading, listening to music and discovering new parts of Sydney. She has also written for the student publications Honi Soit and Vertigo. After she graduates, Zara hopes to do a Masters in creative writing and live overseas, which she cannot wait for!