Thinking about studying a Bachelor of Actuarial Studies at ANU but not sure if you’re making the right decision?

We’re here to give you the clarity you need as we’ve chatted with Aarfa, a third year Actuarial Studies student at ANU, to get insight into all the positives and negatives of the degree, and whether it’s the best match for you.

Let’s hear what she has to say!

Why should you study an Actuarial Studies degree at ANU?

Top 3 Pros of an Actuarial Studies Degree

Top 3 Cons of an Actuarial Studies Degree

Mistakes You Shouldn’t Make

Things to Know Before Starting ANU Actuarial Studies

What Makes this Degree Different

Motivations for Studying ANU Actuarial Studies

Potential Career Paths

Why should you study an Actuarial Studies degree at ANU?

A Bachelor of Actuarial Studies at ANU is an incredibly intensive degree that provides students with broad theoretical knowledge of the actuarial profession through teachings in economics, statistics, and mathematics.

If you’re passionate about mathematical problem-solving, studying a Bachelor of Actuarial Studies is a great opportunity to develop your quantitative skills and work in a progressive and stimulating environment.

Top 3 Pros of an Actuarial Studies degree

#1: Great job prospects

If you study a Bachelor of Actuarial studies, you will develop a very niche and qualified skill set that is highly sought out in the commercial sector.

Due to the difficulty and competitiveness of the degree, actuaries often work in positions of seniority in a business, such as an investment manager or liability manager, and often have roles that are in high demand.

#2: Highly-paid profession

“Graduate jobs offer really high pay in comparison to graduate jobs in accounting, commerce, even in other arts degrees. You’re basically set from the financial aspect,” said Aarfa.

If you’re looking for job security, a great incentive for pursuing a Bachelor of Actuarial Studies is the high salary that is attached to it. In addition to developing a diverse set of skills that are transferable across a range of areas, studying to become an actuary has great financial rewards as one of the world’s highest paid professions!

#3: Opportunities for job growth

“You can keep on studying, keep on increasing your skill set, and the degree itself offers you a lot of flexibility to enter different career paths,” Aarfa highlighted.

As Aarfa said, the possibilities are endless when it comes to opportunities to take your Bachelor of Actuarial Studies in different directions. If you choose to become a qualified actuary, you will need to gain further qualifications after your degree from the Institute of Actuaries.

After becoming a qualified actuary, you can choose to complete the Fellowship Program if you would like to specialise in an area of practice and develop your expertise.

Alternatively, even if you’re not looking to become a qualified actuary, the degree offers tons of career possibilities through a cohesion of different subjects such as business, economics, finance, and statistics.

Top 3 Cons of an Actuarial Studies degree

#1: Very content-heavy

“During the second year, there is a huge jump in the difficulty content and the workload, and that’s why the dropout rate for this degree becomes exponentially high. If you want to survive in this degree, you will have to be very strong minded and driven, otherwise you will lose the motivation to study,” said Aarfa.

As mentioned above in Aarfa’s pro list, the incredibly qualified skill set that Actuarial students acquire comes at the price of an extremely challenging degree. A strong background in Mathematics is essential, and students should also be prepared to spend a lot of time developing their IT and statistical skills.

#2: Needs more actuarial content

“A lot of the actuarial content that we do in third year isn’t as hard as the content that we do in second year. Moreover, there seems to be a lack of connection in the content for the first two years and the third year. The majority of the degree is spent going through generic subjects as opposed to actuarial focussed knowledge,” said Aarfa.

While it may seem strange to see a lack of actuarial content in a Bachelor of Actuarial Studies, the majority of your first and second year is based on developing your theoretical and foundational knowledge of statistics, finance, and economics.

#3: Ambiguity of what an actuary does

“In the minds of students, there is a huge disconnect between the structure of the degree and the work that an actuary would do in the field. It’s really hard to bridge that gap,” shared Aarfa.

According to Aarfa, while studying a Bachelor of Actuarial Studies at ANU, even though you will learn about the practical applications of various theoretical concepts, you won’t be able to comprehend how you would go and apply this information in an actuarial firm until the very last few classes of your degree.

Any regrets?

Interestingly, Aarfa dropped out of medical school in India to do a Bachelor of Actuarial Studies at ANU!

“Sometimes, I regret giving up on my aspiration of becoming a surgeon. But when I think about what I’m doing right now, and I realise how much I enjoy studying Actuarial Studies, I believe that it was all worth it,” explained Aarfa.

Overall, Aarfa’s passion for Actuarial Studies means she really doesn’t have many regrets about coming to ANU. Her main piece of advice is to find a course that provides you with a great balance of your interests and your strengths.

She said, “While choosing a career opportunity, it’s very important that you find a middle ground between what you like to do, and what you’re good at doing, and I think for me, that is Actuarial Studies.”

What do you wish you had known before starting Actuarial Studies at ANU?

“I would have really liked to sort out a lot of computer-based skills before entering the degree, so that I could be more employable and have those skills already on my resume. Now I have to take an online course during my summer holidays or winter break just to make up for that lost time,” said Aarfa.

So if you want to get a head start and know that Actuarial Studies is the degree you’d like to pursue, it could be useful to develop your computer-based skills before starting the course!

What makes this degree different from the ones offered at other universities?

“It’s a very content heavy degree, so you gain so much more knowledge about the field, about statistics, about where the formula comes from, and it really helps you to develop a side of the brain that you might not know that you had,” said Aarfa.

Aarfa tells us that subjects in a Bachelor of Actuarial Studies at ANU are much harder in comparison to other universities, but that’s what makes them so much more rewarding! The breadth and depth of content that you learn really helps to develop your work ethic and quantitative thinking, and there is a lot of support provided within the course to help you enhance your skills.

“Even when the lecturers talk about coding, they teach you from the very basics to the very advanced level. They do not assume that you have any previous knowledge if you are doing a foundation level course, and I think that’s a great aspect of studying at ANU,” shared Aarfa.

Curious about the top universities for Actuarial Studies? Check out our article here!

What inspired you to choose Actuarial Studies at ANU?

For Aarfa, her journey towards choosing a Bachelor of Actuarial Studies at ANU is kind of a funny story!

“I actually didn’t know what Actuarial Studies was until I was in Grade 12! After a year of studying medicine, one of my father’s colleagues told me about Actuarial Studies and recommended that I should give it a shot. Back then, EdX offered a course called ‘Introduction to Actuarial Science’ run by ANU, and I really connected with the course content,” explained Aarfa.

Following her newfound passion for Actuarial Studies, Aarfa decided to apply for various Actuarial colleges, one of which was ANU.

“I chose ANU as I was really impressed by the quality of the teaching in the course, and I was also offered a scholarship (CBE International Scholarship) that gave me a full-ride on my international tuition fees. That was the cherry on top of the cake,” said Aarfa.

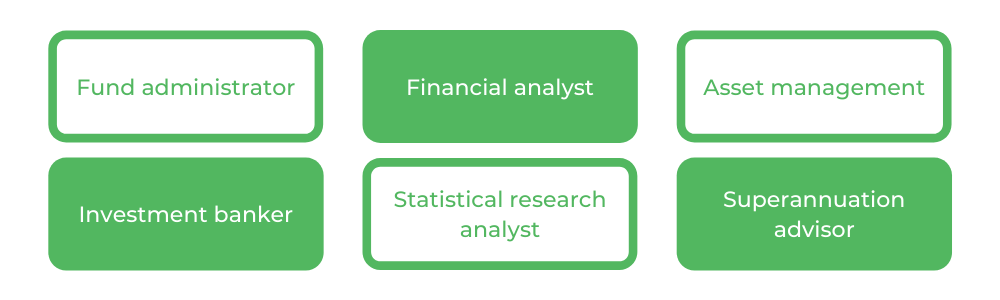

What are the possible career paths?

On top of providing a pathway for students to gain the qualifications to become an accredited actuary, a Bachelor of Actuarial Studies at ANU provides you with a range of attractive career options in the commercial world. A few of the possible roles that you can explore include:

- Fund administrator

- Financial analyst

- Asset management

- Investment banker

- Statistical research analyst

- Superannuation adviser

Ashley Sullivan is a Content Writer for Art of Smart Education and is currently undertaking a double degree in Communications (Journalism) and a Bachelor of Laws at UTS. Ashley’s articles have been published in The Comma and Central News. She is a film, fashion and fiction enthusiast who enjoys learning about philosophy, psychology and unsolved mysteries in her spare time.