So you’ve read all about what it’s like studying a Bachelor of Actuarial Studies at Macquarie Uni, what’s next? How about taking a deeper look into the great and not so great aspects of the course?

We’ve asked Sharon to talk more about this, as someone who has graduated from a Bachelor of Actuarial Studies at MQ Uni.

Let’s dive in!

Why should you study an Actuarial Studies degree at Macquarie?

Top 3 Pros of an Actuarial Studies Degree

Top 3 Cons of an Actuarial Studies Degree

Mistakes You Shouldn’t Make

Things to Know Before Starting Macquarie Actuarial Studies

What Makes this Degree Different

Motivations for Studying Macquarie Actuarial Studies

Potential Career Paths

Why should you study an Actuarial Studies degree at Macquarie?

MQ Uni is also in the top 5 schools to study a Bachelor of Actuarial Studies in Australia for 2021!

Top 3 Pros of an Actuarial Studies degree

#1: Career mobility in the financial industry

“By studying a Bachelor of Actuarial Studies, it opens a great opportunity to work in different areas of the financial industry,” Sharon tells us.

A Bachelor of Actuarial Studies is all about financial management and since almost every company, entity or individual has financial considerations, graduates have a lot of choice and stability in their career path.

These career choices definitely are not boring either and can “range from superannuation to fund management to insurance to investment banking,” Sharon says.

#2: Highly rewarding

For lovers of mathematics, a Bachelor of Actuarial Studies at Macquarie Uni can provide a lot of internal satisfaction because you’ll be learning how to use mathematics in unique methods that have a real impact on the world!

“I’ve been exposed to lots of aspects of mathematics and statistics that high school students would not have ever been exposed to,” Sharon says, “for those who are passionate, there are lots of new concepts and mathematical formulas to uncover [in a Bachelor of Actuarial Studies].”

#3: The skills you master

Instead of working on your Mathematical skills in a general sense, Actuarial Studies students stake their skills in a real-world context — that is, the financial industry.

“The course really empowers you,” Sharon says, “I’ve learned to develop logical thinking and analytical skills on another level.”

Top 3 Cons of an Actuarial Studies degree

#1: An overall challenging degree

“Lots of concepts are quite new, especially for high school students,” Sharon says, “and most of them, at first, are hard to grasp.”

Because Actuarial Studies basically consists of predicting and mitigating financial uncertainty, the mathematical problems and analysis can get quite mind-boggling. It’s a whole new world from the maths you learn at a high-school level.

“The core actuarial units were a bit tougher because they are all new concepts…things high school students would’ve never seen,” Sharon explains, “Maths [in the Bachelor of Actuarial Studies] was also a bit out there in the sense that it was conceptual maths. There’s a lot of proving. I never really saw numbers in my maths classes — just greek alphabets!“

#2: Time commitment

“I was expected to be on campus for class at least 4 times a week for the whole of my degree,” Sharon says.

Any degree isn’t a light commitment. But, more so for a Bachelor of Actuarial Studies, you’ll need a lot of mental focus in your lectures and classes to make sure you completely understand all the concepts. For Sharon, she spent roughly 12-14 hours per week just attending her on-campus classes!

“At times, this can be mentally straining and it’s important to find balance between study and other parts of your life,” Sharon recommends.

#3: The change from high school to university

While you may have excelled in high school mathematics, mathematics in Actuarial Studies is a completely different ball game. A lot of Actuarial Studies students first struggle to understand the new formulas and larger financial context of the calculations.

“You have to spend considerable amounts of time studying the new concepts,” Sharon says.

You may feel unmotivated at first but “after going out of that comfort zone, I definitely feel more confident and feel more of a purpose while doing calculations,” Sharon says.

Any regrets?

Short answer: “Not really.” Sharon tells us, ‘If given the chance to choose again, I would still choose to do Actuarial Studies!‘

What do you wish you had known before starting Actuarial Studies at Macquarie?

For any commencing university student, there’s going to be aspects of their degree that they didn’t anticipate. For Sharon, it was realising that there is a strong emphasis on the finance industry in Actuarial Studies.

“Actuarial Studies combines economics, business and mathematics,” Sharon says, “Apart from just having exceptional mathematics skills, it also requires the individual to have basic understanding and or interest in the financial industry.“

What makes this degree different from the ones offered at other universities?

“Many of Macquarie University’s units allows for the student to be exempted from the Foundation level professional examinations (professional exams required to achieve fellowship),” Sharon tells us, “This is if they achieved an adequate grade.”

Only a handful of Bachelor of Actuarial Studies degrees across Australia provide accreditation from the Actuaries Institute — so this will make you stand out when going into your profession as a graduate!

What inspired you to choose Actuarial Studies at Macquarie?

“I excelled and was interested in mathematics and hence decided to pursue a degree that would utilise or consist of higher level mathematics,” Sharon explains, “Actuarial studies also taught about the financial industry which is something I was also intrigued about.”

So, anyone who is interested in mathematics, the financial industry and preferably both should definitely consider this degree.

In relation to MQ uni, Sharon tells us, “I chose Macquarie university as its Actuarial Studies degree has been highly praised by many industries as opposed to the same degree offered by other universities.”

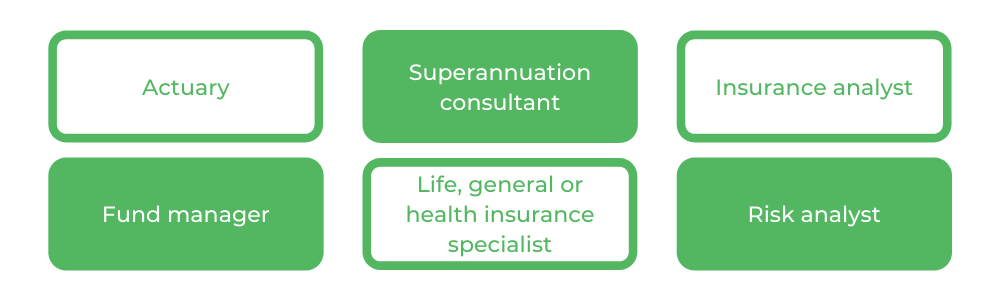

What are the possible career paths?

With a Bachelor of Actuarial Studies at MQ Uni, you’ll have a variety of career options and some of which include:

-

- Actuary

- Superannuation consultant

- Insurance analyst

- Fund manager

- Life, general or health insurance specialist

- Risk analyst

Common workplaces include accounting firms, insurance companies and consulting firms!

Lynn Chen is a Content Writer at Art of Smart Education and is a Communication student at UTS with a major in Creative Writing. Lynn’s articles have been published in Vertigo, The Comma, and Shut Up and Go. In her spare time, she also writes poetry.