What is an actuary? What does an actuary do? And how does one become an actuary?

All very valid questions and we’ve got your answers!

Whether you’re a maths whiz, a number cruncher, or just want to find out a little more about the actuarial field, you’ve come to the right place.

Take a look!

Meet Shivee

What is an Actuary?

Steps to Becoming an Actuary

Future Outlook

Best Thing & Worst Thing

Advice for Aspiring Actuaries

Meet Shivee

Shivee’s an actuary at the Swiss Re Insurance company working in the Corporate Solutions branch. His official title is Actuary CorSo — CorSo like Corporate Solutions. Cool, right?

He’s been working at Swiss Re for about 8 months now but has been working as an actuary for a little over 10 years!

Statistics seems to be a bit of a buzzword in the actuarial discipline, for Shivee at least, because his education was full of it.

How did you end up in this role?

To get to where he is now, Shivee studied a Bachelor of Statistics (Honours) and then a Masters of Statistics. Afterwards, he went on to complete an Associate’s degree at the Institute and Faculty of Actuaries in the UK!

What made you want to work in this industry?

Shivee told us that the reason he felt so drawn to becoming an actuary was because understanding numbers came so naturally to him.

“What I like most about the position is the numbers. I love numbers. I don’t like many of the arts subjects because those don’t really come naturally to me. Actuaries are number-driven so you can really dig deep into the numbers and tell a story through them — that’s always been the most interesting part to me,” Shivee said.

What is an Actuary?

An actuary will use statistical, mathematical, financial and economic skills to understand and evaluate the opportunity and risk involved in particular companies. This means that an actuary will predict the likelihood of damage and uncertainty by measuring the possible financial impacts.

There are a number of industries where actuaries work! Wherever they are, they’ll almost always be analysing data, managing risks and making data-based decisions.

If you’ve got a knack for numbers and data, then becoming an actuary may be the perfect position for you!

Roles and Responsibilities

As with most jobs and career paths, the tasks that you’ll perform on a day to day basis will change as you progress through the ranks.

Junior actuaries will typically begin as actuarial analysts, assistant actuaries or data analysts. You can expect to be spending a lot of your early years working heavily with data, economics and finance. If you’re choosing your Year 12 subjects as a wannabe actuary then you’ll probably be looking into taking Business Studies, Mathematics and Economics!

Once you progress to a senior actuary position you can expect your roles to look a little more advanced and a lot more responsibility-driven. You’ll be making the big decisions and will be covering all different actuarial tasks.

At this point, you’ll be like the wheels of the company. As a committed part of the business, your actuarial decisions will be the main driving force behind the company’s direction, strategy and success. So, if you’re decisive and can lead a team, a position as an actuary may be just the one for you.

Shivee told us that, he specifically, will spend a lot of his time ‘reserving’. He tells the insurance companies how much money they should set aside in order to pay for costly events which may occur in the future.

So, what I’m hearing is not only is Shivee a finance whiz but a substantial part of his role is also dedicated to predicting the future!

Shivee told us a little bit more about the reserving he does, “The insurance that we’ve sold to a company will prevent them from bearing losses from, let’s say, an earthquake or a flood. If we are covering such companies and such an event happens, then it’s our job to keep in mind how much insurance we’ll need to pay in the future.”

Which industries can this career be found in?

For the most part, actuaries work in fields like:

- Insurance (like Shivee)

- Investment

- Superannuation

- Banking

- Health financing

- Data analytics

- Energy and environment resources

- Wealth management

You’ll find actuaries in almost all industries that involve finances and data. They are essential throughout the workforce to measure the financial impact of risks.

Characteristics and Qualities

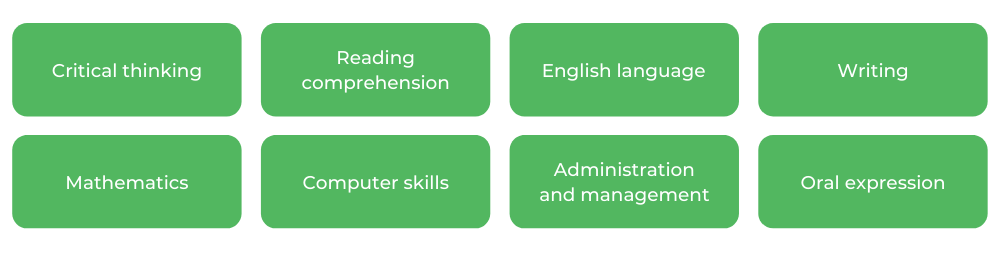

According to JobOutlook, the top skills and knowledge that actuaries should possess include:

- Mathematics

- Reading Comprehension

- Critical Thinking

- Computer Skills

- English Language

- Administration and Management

- Writing

- Oral Expression

The defining characteristic of an actuarial position is mathematical and numerical confidence. An actuary’s tasks will typically revolve around solving complex financial complications such as issues relating to annuities, superannuation, pensions, funds, dividends and insurance premiums.

As an actuary, you’ll be applying numerical analysis to data, computations and particular trends across a business!

Since you’ll also be working with written policies that evaluate the risks and other financial areas, your oral expression and English language skills will be imperative. So, while an actuary’s job will largely depend on understanding numbers and formulas, proficient writing skills are equally as important!

What skills are required as an actuary?

Let’s make one thing clear now — to be an actuary, you don’t need to possess all of these skills right now. You’ll be developing them as you study and as you begin your professional work.

So don’t fret if you want to be an actuary but don’t think you have all of these skills — you’ll learn through practice!

Shivee told us that knowledge in statistics, finance, economics, data manipulation and coding are becoming more and more important as an actuary.

“Actuarial skills are typically developed in two ways. Either through professional experience or university education like actuarial science subjects. So once you start studying or working, you’ll start getting those skills,” Shivee said.

Steps to Becoming an Actuary

For Shivee, the steps involved in becoming an actuary were twofold: university education and work experience.

At university, he studied a Bachelor of Statistics (Honours) and then went on to study a Master of Statistics before finalising his tertiary studies with an Associate’s degree at the Institute and Faculty of Actuaries in the UK.

“Initially I started studying just to test the waters to see if I was up to it and whether it was for me. I did pretty well in my exams. During my studies, I found I was really enjoying the subject and it came really naturally to me,” Shivee told us.

What should you study?

Similar to Shivee, a Bachelor’s degree in a discipline like Maths, Statistics or Actuarial Sciences is the only qualification that you need from uni. However, according to JobOutlook, it’s common among actuaries for postgraduate studies to be completed.

You can then become an accredited actuary in Australia by following the Actuaries Institute’s Education Program. The program is a 3-part course that involves a Foundation Program, an Actuary Program and a Fellowship Program.

Macquarie University offers a Bachelor of Actuarial Studies course for high-performing students that receive an ATAR of 97. It’s a 3 year course that includes a work experience unit and is accredited by the Actuaries Institute.

If you complete a Bachelor’s degree in actuarial studies or a related discipline, you can apply for an exemption from the Actuaries Institute’s Foundation Level examinations.

Check out these universities for Actuarial Studies:

How long does it take to become an Actuary?

Overall, you’ll be looking at a little over 7 years of studies before becoming a practicing actuary. It’s a tough job! But it’s something that will be totally worth it if you put in the work.

Industry Knowledge

As an actuary, your job will revolve pretty heavily around computer skills so there’s quite a lot of software that you’ll be needing to get your head around.

Shivee told us that there are specific softwares sold to insurance companies. Some that he uses include:

- Microsoft Excel

- R Project

- Igloo

- ReMetrica

What will this career look like in the future?

The actuary industry will most likely continue to be in high-demand despite expected technological changes in the future. Luckily for actuaries, risk is always going to be there.

Even when AI and robotics become the new norm, companies will still need to protect themselves from losses. Shivee even told us that he thinks the industry will grow in the future!

“Nowadays, industries that have risks are developing even more. The demand is higher due to new kinds of risks being involved in new technologies like cyber risk, pandemics and automatic cars. So many new technologies are coming which are bringing more risk and needing more actuaries,” Shivee said.

He also thinks that coding will become more important than ever with the development of robotics in the future.

Are there opportunities to grow or specialise?

Shivee told us that actuaries have plenty of opportunities to grow in their company. He started as a junior actuary, made his way up to a senior actuary and has since had opportunities to work directly with the CEO!

“The sky is the limit. As an actuary, you really get to see how the company functions from an overall perspective. You’re in a better position to know what works and you can use that to develop,” Shivee said.

Salary

| Annual Salary | Future Growth | Skill Level Rating |

|---|---|---|

| $107,000+ | Strong over the next 5 years | Very high skill |

Best Thing & Worst Thing

What do you enjoy most about this job?

Shivee told us that his favourite part of being an actuary is being able to directly impact a company.

“I enjoy knowing the impact that my work can make and knowing the responsibility that comes with it. The work that I have produced affects what the company looks like and how the company’s future looks so it’s a big responsibility and I like to take responsibility,” he said.

What do you feel is the worst part of this job?

Shivee has made it pretty clear that he loves his job and it’s perfect for his character. After a bit of deliberation, he said that his least favourite part of being an actuary was a task he had to complete when he first started.

He said that one time he had to create user manuals for an actuarial pool. “Although it was quite burdensome, it still ended up being useful because it helped me learn,” Shivee added.

Advice for Aspiring Actuaries

Why should people consider taking on this career?

“I would say, first of all, that being an actuary isn’t easy. It’s a complex career so you will have to undergo internships and training to see if it would be right for you. In your first year, you’ll see whether you like it or not. It is a demanding career but once you are through with the first few years and you’ve developed a liking for it, and you have the exams out of the way, then there is no stopping you,” Shivee advised.

Shivee’s main tips for an up and coming actuary is to undergo as many internships as you can, talk to other actuaries and study the career online.

What do you wish you had known before you started working in this career?

The two main things that Shivee wished he had known were to take advantage of internships and get the exams completed sooner rather than later. Take note, student actuaries!

“I’d recommend using your first years to get those exams out of the way. Because once you are in a company and are working full-time, completing the exams becomes more and more difficult,” Shivee said.

“Secondly, during your university course, get internships if you can to see what this world is all about,” he added.

Shivee said that he had a colleague who hadn’t done an internship before and got onto the team only to realise that he wasn’t so keen on the position after all.

What is the workplace culture and job flexibility like?

Shivee said that the company he works for does its best to provide a flexible and supportive environment for its employees. “In the global company that I work for, they call it ‘owning the way you work’, so as long as the work is getting done, no one really pressures you,” he said.

“You can work at your own pace and from home,” he added.

Since the company that Shivee works for has branches all over the world, he said that sometimes he’ll have to be on call during out of work hours. But for Shivee, this isn’t a problem.

“I’m quite flexible which I think is another important skill if you’re wanting to work for a global company. But that doesn’t mean I’m working all day. I could start at 12 and then work until 8 or 9,” he explained.

If you’re considering a career as an Actuary, we hope this article has helped you gain more clarity!

Check out the Top 5 universities for Actuarial Studies in Australia here!

Gemma Billington is a Content Writer at Art of Smart and an undergraduate student at the University of Technology Sydney. While studying Journalism and Social and Political Sciences, Gemma enjoys spending her time at the gym or reading about Britain’s medieval monarchy – ideally not at the same time. She currently creates and administers social media posts for Central News and writes for the student publication, The Comma. After completing her undergraduate degree, she hopes to study a Masters of Medieval History and is very excited about the prospect!